Where the current tax and cost of living debates are concerned, justice for the poor means nothing short of introducing new wealth taxes instead of a GST hike.

According to a Mediacorp poll of 1000 people, 83% said higher-income persons should be taxed more. When asked whether they were worried that taxes on the wealthy could lead to the rich leaving Singapore, 78% of respondents said that they were not worried.

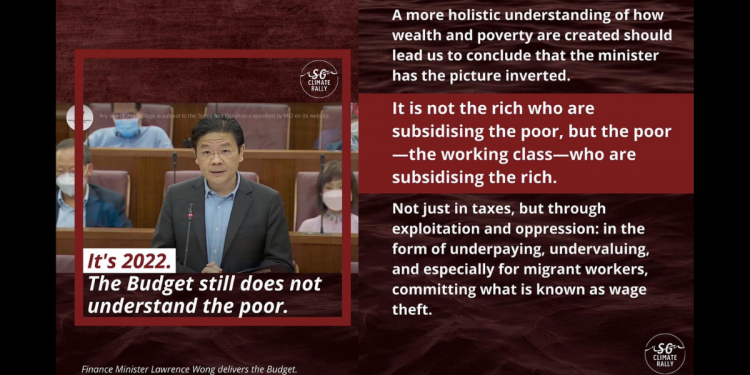

In response, this is what Finance Minister Lawrence Wong said:

“On average, lower-income groups get back S$4 of benefits for every dollar of tax paid, middle-income earners get S$2 and the higher-income get only 30 cents, he said, reiterating a point that the Government has made about how Singapore’s overall tax and government transfers system is fair and progressive.

“So, the net contributors are the higher-income groups.”

Cloaked in objective-looking statistics, this at first appears like a convincing argument by the Minister about how the poor are apparently getting more per dollar they pay in taxes compared to the rich. This portrait of the poor gives the impression that they are taking more than they are giving, feeding into the stereotype that they are lazy and lucky to have any welfare support at all. As a result, support measures to help the poor in the budget are seen as acts of “generosity” by the government.

This is a misleading picture of poverty. The minister’s argument does not account for how many low-income workers are already undervalued and underpaid because the bulk of the wealth they help create is absorbed by the rich who employ them. Employers and investors want to maximise profit and this is always at the expense of someone’s wages. It is often the jobs at the lowest end of the supply chain that end up the least paid despite doing essential labour.

In other words, contrary to the Minister’s views, it is not the rich who are subsidising the poor but the poor who are subsidising the rich at their own expense.

For a general indication, look at how much the rich benefited during the pandemic compared to those with lower incomes. In 2020, more than half of lower-income earners saw their earnings decline by more than 50%. Also in 2020, it was revealed in parliament that 52,000 Singaporeans earn less than $1300 a month (inclusive of pensions and workfare supplement). In contrast, Singapore’s 50 richest saw $37 billion added to their wealth.

In response to the Minister’s tax statistics, let’s compare how much the CEO of Grab makes for every hour of work versus a food delivery rider: Amazon founder Jeff Bezos earns $142,667 per minute. This is more than how much the median US worker makes in one year.

Think about food delivery riders who are classified as “partners” rather than workers. Platforms exploit the desperation of really poor people who need quick income (or what they call “cash pay job”) by classifying them as partners, therefore not requiring them to accord them benefits, and profiting from that. This difference in legal language means cost savings for the platform owners at the expense of the riders. Platforms that “contract” them are not legally obliged to provide riders with adequate insurance and many other labour laws that, for example, mandate that workers should be granted paid annual leave. This allows the platforms to pocket more from the riders’ labour than if they were to be contracted as ordinary workers in the eyes of law. Are platforms not exploiting a legal loophole to earn more on the backs of desperate workers?

And who compensates the riders for this loss in income? Is it fair that some riders pile up housing and medical debts while platform owners purchase multi-million dollar Good Class Bungalows from the income the riders’ labour helps create?

To give a numerical sense of how much workers are under-valued (and thus underpaid) in Singapore, a study showed that foreign domestic workers (FDWs) contribute 11.1 billion SGD to the country’s economy. In contrast, each FDW gets paid a few hundred SGD per month in wages. What more, for other blue collared jobs that both local and migrant workers do?

A more holistic understanding of how wealth and poverty are created should lead us to conclude that the minister has the picture inverted. It is not the rich who are subsidising the poor, but the poor—the working class—who are subsidising the rich. Not just in taxes, but through exploitation and oppression: in the form of underpaying, undervaluing, and especially for migrant workers, committing what is known as wage theft. And one way the government can step in to level the playing field is to re-distribute some of the gains hoarded by the rich back to the poor.

This is why the majority who responded to the survey are correct. The rich should be taxed much more. The poor do not need false generosity. They need justice. Justice for the poor can look like many things: providing free and adequate ART test kits and PPEs that currently cost $25-$30 per box, ensuring all of the poor are food secure, that no one needs to worry about accumulating debt on rent, electricity, and utilities bills.

With 10% of Singaporeans already considered food insecure, regardless of GST vouchers, the insistence on a GST hike could prove fatal for the poor. To make matters worse, low-wage migrants (especially foreign spouses and migrant workers on work permits) are not even eligible for the vouchers. Where the current tax and cost of living debates are concerned, justice for the poor means nothing short of introducing new wealth taxes instead of a GST hike.

This article originally appeared on Singapore Climate Rally’s website.

Since you have made it to the end of the article, follow Wake Up Singapore on Telegram!