A new debate has begun in Malaysia regarding the taxation of social media influencers’ income. The country’s government recently released tax guidelines for influencers, which have already sparked widespread discussion online. Many content creators believe that this is a new tax law.

However, in reality, it is just an interpretation of the existing income tax law. Experts say that it is wiser to work in a structured manner than to panic without understanding the rules.

Background to the Tax Guidelines

On 14 January 2026, the Malaysian Board of Inland Revenue (LHDN) released a guideline on taxing influencers’ income. It clarified that this is not a new law. Rather, it explains how influencer income will be applied according to the Income Tax Act 1967.

As a result, many people think that the tax will only be effective from the future. In fact, the rules were already in place.

As a result, many people think that the tax will only be effective from the future. In fact, the rules were already in place.

Who is an Influencer?

According to the LHDN definition, an influencer is someone who earns by creating content on social media. There is no limit to the number of followers. This includes promoting products, participating in events, posting videos or writing.

In addition to cash, gifts or free services will also be considered part of the income. So everyone from students to professionals can read this list.

Which Income is Taxable

The guidelines state that both cash and non-cash income are taxable. Money received from YouTube, TikTok or Instagram will be subject to tax. Free products, travel or vouchers given by the brand will also be considered part of the income.

Even if there is no written agreement, the benefits received in exchange for promotion must be declared. Even if the income is from a foreign platform, if the activity is carried out in Malaysia, it is taxable.

Expenses and Documents

Experts say that influencers have nothing to fear, but the main thing is to show the expenses correctly. Camera, phone, internet, software, shooting food or travel expenses can be claimed. Even a part of the house can be shown as a workplace.

However, proper receipts and documents must be kept for everything. Records must be kept for at least seven years.

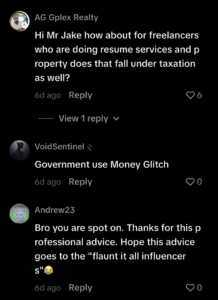

Netizens’ Reactions

There have been various reactions on social media regarding this announcement. Some have raised questions as to whether freelancers or those who provide services on resumes will also be subject to tax. Others have criticized the government, saying that additional pressure is being created on the common man.

However, many have praised this explanation as timely and realistic. Many have opined that it is instructive, especially for those who show income.

However, many have praised this explanation as timely and realistic. Many have opined that it is instructive, especially for those who show income.

Watch the video here.

@jakeabdullah65 Watch and learn

More from Wake Up Singapore:

10 Million Fine or 10 Years In Jail: Malaysia’s New Rules For ‘Finfluencers’

China’s Online Influencer Rules: Verified Professional Qualification Required for Internet Advice

No More Decades-Long Rule: Malaysia Plans Two-Term Limit for PMs

If you have a story or a tip-off, email admin@wakeup.sg or get in touch via Whatsapp at 8882 5913.

Interested in advertising on our media channels? Reach out to us at admin@wakeup.sg!

Since you have made it to the end of the article, follow Wake Up Singapore on Telegram and X!

Wake Up Singapore is a volunteer-run site that covers alternative views in Singapore. If you want to volunteer with us, sign up here!