‘Raiding our reserves’ is a common refrain from members of the PAP Government whenever alternative policy proposals are put forth. This charge was also surfaced in recent policy debates surrounding the affordability, or lack thereof, of HDB flats in Singapore.

In light of the fact that no one, save for a select few individuals, know how much we actually have in our reserves, it is hard to really assess the veracity of whether the reserves will actually be ‘raided’ or even dented if alternative policy proposals are implemented. In other words, it is a retort that is almost impossible to respond to due to the inequality of arms and the absence of freedom of information.

As the comedian Mark Lee so eloquently says, ‘Win Liao Lor!’

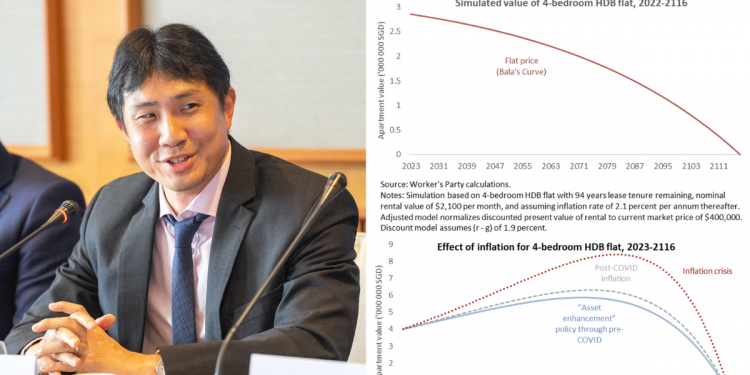

Be that as it may, Associate Professor Jamus Lim’s speech in Parliament, which is set out in full below, essentially demolishes the argument of ‘raiding’ the reserves with reference to, well, the Government’s own standards.

Housing Prices are too High

Mr Speaker, as we do our rounds with our constituents during our house visits, we would undoubtedly have met those who have expressed their concern about the rising cost of living. This is not a recent phenomenon. While rising prices of groceries or gas may have dominated our more recent conversations, fears about how it is increasingly difficult to live in Singapore have been shared many times over in the past.

In Sengkang, I’ve spoken to residents—even elderly ones who own their own homes— who worry about how expensive buying a flat in Singapore is, and fear especially for their children and grandchildren’s ability to continue affording a roof over their heads.

Newspaper reports that point to record highs in property prices and rents in many districts reinforce this notion that housing is unaffordable. My contribution to this debate will focus on what is driving these high house prices, but I will end by some proposals for easing a transition as we seek a reset to house pricing.

HDB as a Public Housing Success

HDB remains a success in public housing globally, producing what some regard to be among the most-admired public housing worldwide. But it has been less successful in meeting some of its original goals, most crucially in terms of affordability and access.My Workers’ Party colleagues Leon Perera and Gerald Giam will, in their speeches, elaborate on these aspects. Here, I will only point out that house prices are, according to one respected index, “seriously unaffordable.” This has knock-on effects on our cost of living and, crucially, our retirement savings.

The fundamental tension between housing as a retirement asset and as a home

The way the government has tried to thread this needle has been to provide taxpayer financed subsidies to young families trying to purchase their first home. Hence, built to-order (BTO), Sales of Balance (SBF), and even resale purchasers enjoy a bevy of grants to help them get on the local property ladder. For many of these schemes, they may even get to enjoy two bites of the cherry. Once you’re on the ladder, there is less worry that house prices might run away from you, because when you sell your place, you’ll receive the market price, so even if prices are too high, you’ll at least have the cash from your sale to offset the hit.

What this approach does is to use tax revenue to offset the hit from costly market pricing of public housing, in an effort to preserve the affordability of HDB flats, and enabling the asset enhancement aspect of public housing to remain in place. It reassures those who have plumped a good part of their retirement savings into real estate that they will eventually be able to realize the investment gains from this decision.

Moreover, since most HDB homeowners also use their Central Provident Fund (CPF) savings to pay for their mortgage, the status quo also allows them to extract funds that would otherwise be locked up in their CPF. This preserves their monthly disposable income, and also helps them to commit to saving for their retirement. On the surface, everyone wins.

But what this does is conflate two competing ideals: growing retirement assets as much as possible to ensure retirement adequacy, while simultaneously keeping public housing as affordable as possible, so that Singaporeans have a roof over their heads that they may call home. The two public policy pillars of HDB and CPF have objectives that run counter to each other, and tying them together requires grants to align them.

Which might not be a problem, except that—like the proverbial hamster that finds that it has to run faster and faster just to keep up with the spinning wheel—we find that escalating house prices in turn require the government to keep enhancing the grants it gives out, which allows prices to run away even further, in a never-ending, self-reinforcing cycle.

Rational pricing of HDB flats

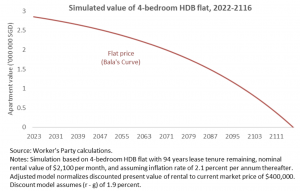

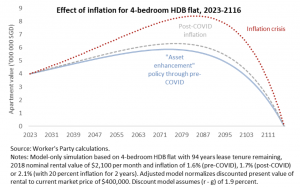

In principle, any asset with a finite shelf life should have a very clear path of future prices: every year—as we gradually approach the point of time when it will expire with no value—the price will drop by a little bit. Because of the technicalities of how we value time (that is, we tend to prefer the present to the future), you tend to see a smaller decline each year at the beginning, but as we stretch out further, prices will drop by ever-greater increments. A picture tells a thousand words.

In Singapore, policymakers have enshrined this relationship as “Bala’s Curve,” which lore attributes to a land office employee with that name who first drew up this theoretical relationship for 99-year leasehold properties.

The premise behind the curve is as elegant as it looks. The price of the house should be worth what you would otherwise pay in rent. If you buy, you’re essentially frontloading your payments, so after you’re done with your mortgage, you get to enjoy living rent-free in your home. But the valuation of your home is still whatever is the

accumulated sum of what you would otherwise be paying in rent, for the remainder of the time the house is still yours.

But I’ll ask you to cast your eyes to the other chart above. There you’ll see essentially the same curve, but with just very mild variation: we allow inflation into the picture, so that it’ll affect what you’d pay in rent, every year, into the future. With just this simple tweak, we see exactly what we observe in Singapore’s housing market:

a steadily-rising house price, which tops out somewhere around the two-thirds mark of their total lease. This is also, incidentally, what real estate agents often share about how they believe flat prices will move when leases are in the final three decades: that they are basically impossible to sell, and if they were, their prices fall precipitously.

The chart actually shows three lines, which correspond to different average inflation rates over the period. First of all, observe how, as inflation rises, the curve rises more. But the plunge is also more severe once we pass the peak. So inflation—such as the bout of what we’ve experienced recently—is at least partially responsible for the spike in house prices.

What do these three inflation rates correspond to? They were not selected by chance. The first is inflation ever since 1991, when the government began adopting its asset enhancement approach. The second is what happens when we add in the higherinflation post-pandemic period. Just two years of above-average inflation was sufficient to trigger a significant increase in house prices at the peak, relative to the business-as-usual scenario. Finally, the last line is what happens when we have a house price inflation crisis, when rents are rising as they were last year, and if they remain elevated this year. At the peak, house prices would be more than double what they would be in the absence of this bubble.

That’s why, even though the overwhelming majority of Singaporeans do not rent, the eye-watering 30 percent jump in private rental rates last year8 should worry all of us: higher rents eventually make their way into higher house prices, and vice versa. And given our recent brush with high inflation, it should be unsurprising that house prices have likewise breached new highs.

This just means the need for even bigger taxpayer funded grants from the government, if we wish to keep housing affordable. It also means that our current HDB and CPF policies may be a dangerous game of musical chairs. If one is able to offload one’s flat before its price collapses—as it must, eventually—then we can retire comfortably. But then, the one holding the bag is a fellow Singaporean, who bought your resale because they needed the space for a growing family, and couldn’t afford to wait for a BTO.

Breaking down the contributors to high house prices

Of course, some might argue that using (the discounted value of) rent to determine house prices is only one method, and solely relying on this approach to explain high house prices could be misleading. That is correct. There is at least one other common way to determine valuation, which we can think of as an adding-up approach: basically, we add in the price of land, construction costs, and developer profit, to arrive at a

price.

The unknown factor in this, of course, is what that land should cost. The Minister for National Development recently explained this further. Mr Lee told us that land sale prices for private housing developments are not used, but that “relevant public housing transactions” are used instead.

But if this is true, then we have not unshackled ourselves from the possibility that the land component of public housing—even for new BTOs—may be overvalued. If land prices are indirectly derived from the HDB resale market, with transaction prices used as comparables, then any bubble in that market will become embedded into our BTO prices. What’s worse, this can bubble feed on itself, as the resale market crossreferences the BTO one, back and forth.

What is needed, then, is a way for us to price land not in reference to the market, but in a way we can justify via fundamentals. One approach is to peg this to the historical acquisition price, or—as Mr Leong Mun Wai has suggested today—to value it, but only realize the cost when the flat is sold for profit.

Another is to do so as a multiple of median salaries of new owners—the Workers’ Party would prefer a multiple closer to 3—but, crucially, to do this preemptively, instead of as a target after market valuations have been obtained. Doing so will ensure that it is the HDB that is driving affordability, not trying to catch up to the market with subsidies; so the tail does not wag the dog.

The key is to break the tight link between land valuation that takes reference to market comparables, and thereby deflate the bubble component that could build up in land pricing.

Let’s get some preliminary objections out of the way. A common refrain by this government is that it is simply following well-established, market principles of land valuation. And should there be any deviation from this approach, it would amount to raiding of the reserves, since our land trust belongs to not just the current but also all future generations of Singaporeans.

First off, this argument is—even by the government’s own accounting conventions— fundamentally incoherent. SLA already exempts land leases of less than 7 years from registration,13 and the MoF currently treats income from land leases lasting less than 10 years as recurrent income.14 If it is true that carving out a part of the lease amounts to “raiding” the reserves, then this government has also done the same for every short term land lease it makes, where the proceeds are credited as recurrent revenue.

Furthermore, the government already exercises differential land pricing for different classes and uses of land. Land zoned for private residential purposes are valued differently from those for commercial uses, and also differently from land used for infrastructure such as roads. Recognizing the inherent public nature of roads and transit ways, the land charge for this group is a mere dollar a meter.15 While we’re not suggesting that HDB land should be priced at some unreasonably low quantum, it is fair to ask why land for public housing doesn’t better reflect its public nature.

Let’s also be clear-eyed about what the tradeoff we are making is about. The government is asking new homebuyers today to pay more for their BTO and resale flats, a significant part of which goes toward land costs, which in turn is channeled into reserves. So we are, in effect, asking the present generation to pay more to support future ones. Is this fair or just?

There isn’t a single right answer, but let’s at least acknowledge that it isn’t necessarily selfish or greedy or even lacking in foresight to want some of the benefits of our land trust to be realized today. After all, we all want the best for our children. Sometimes, that means leaving behind a sound inheritance. But it is also about providing for them today, with a roof over their heads, and the comfort of a home. It is also about being present for them as they grow up, and not constantly pulling long hours at work just so that we can afford the house that they live in.

More generally, we should recognize that the market doesn’t price everything perfectly, and perhaps more crucially, it doesn’t price everything that is important in life. In this case, while the market is able to price—even if imperfectly—the value of land, it fails to price the value of the right to shelter, and in particular, affordable shelter. A friend once liked to quip that “price is what you pay, but value is what you get.” Economists fully understand this, which is why we don’t rely solely on the market to govern our lives. So while it’s probably true that it would be a step too far to price land at zero, it is also not unreasonable to say that we should value public land in a way that simultaneously reflects these intangible values.

A return to rational pricing of HDB flats requires an orderly transition

Mr Speaker, I have explained why house prices are too high. What we need is a reboot, but if we were to do so, the fear is that the transition can be disruptive. We already have homeowners with mortgages in public housing, who have contractual obligations to their banks based on current valuations.

What will happen when we reset prices downward? Even if we only roll these out for new flats, the cheaper pool of available public housing is likely to lower the resale value of the remaining existing stock. The effects won’t be limited to public housing, either; were HDB prices to tank, private home prices will likely follow suit.Those who plan to sell to extract funds to finance their retirement may suddenly find themselves with less savings than they expected, and those with mortgages may well find themselves underwater (where what they owe the bank exceeds the market price of their houses). Banks could in turn be faced with a slew of nonperforming loans, and worse if homeowners choose to forfeit their stake.

This would be a disaster scenario—not unlike the aftermath of a financial crisis—but this doesn’t mean that we allow a bubble to grow even more inexorably. What is needed is a gentle path to this new normal, so that economic growth and, especially, incomes eventually catch up, and make higher prices justifiable.

Let’s start by recognizing that this won’t generally affect the vast majority of homeowners, either because they plan to stay in their homes, or pass it down to their children. They will face paper losses, but this will likely be temporary; their day-to-day will remain unchanged.

It will affect those who are currently overinvested in housing, and wish to cash out for various reasons. In this case, the government may need to step in to buy up excess leases—perhaps up to 30 years—to provide a cushion. There is already a system in place for this—the Selective Enbloc Redevelopment Scheme (SERS) or the Voluntary Early Redevelopment Scheme (VERS)—although details on each have yet to be ironed out by the government. The Workers’ Party, on our part, have proposed a Universal Sale and Lease Buyback Scheme, which differs in that we do not require a return of lease buyback amounts to CPF.

What do we do with those who have sold their flats? There is, of course, the existing short-lease 2-room Flexi Flats, which are rationally priced according to Bala’s Curve, because they are always resold to HDB.

Alternatively, we can introduce limited-duration public rental units, available for rent for a maximum of 10 years. My Sengkang colleague Louis Chua has previously shared details on a more comprehensive public housing scheme, which will expand public rentals to include larger-format units, and relax the eligibility criteria. Add to this a time limit, which will further minimize potential abuse. This scheme will ensure a roof over the heads of families who still wish to eventually own, but allow them to wait out the market until the reset is complete. And while we do need to alleviate supply backlogs in the near term, this strategy will prevent overbuilding in the medium term, since more resale flats will eventually enter the market down the road, from elderly owners who will pass on, but whose children already have flats of their own.

In her response to Mr Chua’s speech, SMS Sim Ann pushed back against the notion of expanded public rentals, suggesting that it could “weaken our communities.” Hopefully, our exercise here makes it clear that, purely from an economic perspective, there isn’t a big difference between what it means to lease, versus rent. There isn’t some magic associated with rental versus lesseeship; by leasing, you are simply making a choice to pay a bunch of your future rents, up front. This comes with some privileges, but also with responsibilities.

For at least a decade of my life, I was also a renter. I did not feel less connected to the communities where I lived, nor did I feel less pride in customizing the interior of my home to reflect who I was. I saw it, rightly, as a stage in life, and once I was ready for ownership, I made the transition. I do not see why we should not offer this opportunity to all Singaporeans, especially those who are not in the lowest percentiles of income, but who nevertheless cannot afford rentals in an open market that, as I’ve shared, has also become unmoored from affordability.

The bottom line is that we need to allow a wider range of housing options for Singaporeans, who may be at different stages of their lives and careers, to allow them to sever what is clearly becoming an ever-more untenable link between affordable housing and retirement adequacy.

More from Wake Up Singapore:

Since you have made it to the end of the article, follow Wake Up Singapore on Telegram!